The government is now operating in accordance with the Guidance on Caretaker Conventions, pending the outcome of the 2025 federal election.

Partnerships make for international transfer success in Southeast Asia and beyond

EzyRemit is expanding across Southeast Asia and North America with assistance from Austrade.

EzyRemit was founded in 2020 to offer international payment and remittance services to the Vietnamese diaspora. Today, the fintech’s money transfer service has expanded to more than 50 countries. Its rapid success earned the company a spot on The Australian Financial Review’s 2023 Fast Starters list.

Remittance is simply the transfer of money as a gift or payment. What is not simple is traversing global financial systems. EzyRemit’s approach is to partner with major banks and financial institutions to deliver its fast, simple and secure services.

Austrade has connected the company to high-value partners in Vietnam, Indonesia and Canada. Austrade has also provided export guidance, introductions and business-matching services in Malaysia, the Philippines, Singapore and Thailand.

‘We are lucky to be working with Austrade,’ says EzyRemit’s Chief Financial Officer and Co-founder, Allan Nguyen. ‘Working with partners is crucial to our business. It allows us to offer low fees and good exchange rates. Austrade connects us to partners in market, boosting our global distribution power.’

From Australia to international markets

Quoc Ngo and Allan Nguyen founded the business in Sydney to make international money transfers. They identified a niche customer base: helping international students send and receive money, and businesses that require international payments. EzyRemit’s remittance platform is now used by individuals and businesses globally.

EzyRemit’s first international market was Vietnam, partnering at the highest level for success. In July 2023, with support from Austrade, the company signed a Memorandum of Understanding (MoU) with Vietcombank Remittance. Vietcombank is majority owned by the State Bank of Vietnam, the country’s central bank.

Through Austrade, the company continues to build on connections with government and stakeholders in the financial ecosystem. In Singapore, Austrade has provided profile support, introducing EzyRemit to potential investors and fintech accelerator programs.

The fintech has expanded from Vietnam, servicing customers in the education, banking and business sectors globally. Today, EzyRemit has offices in Australia, Vietnam, Japan, Canada, the US and New Zealand.

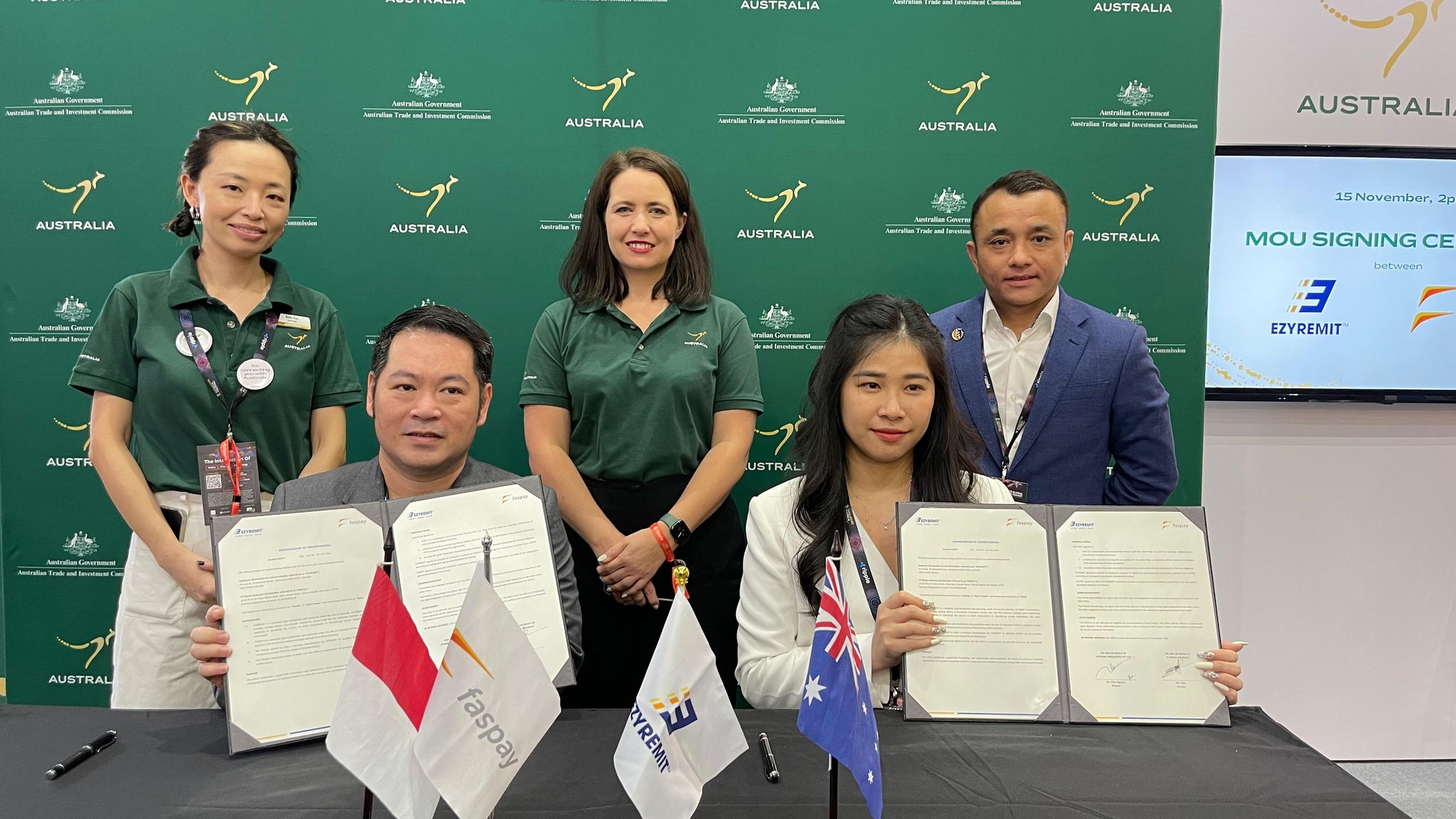

EzyRemit signs an MoU with Indonesian remittance service Faspay at the Singapore Fintech Festival 2023.

Singapore Landing Pad opens doors to Indonesia and North America

EzyRemit was one of 39 fintechs that formed the Team Australia Landing Pad delegation to the 2023 Singapore FinTech Festival (SFF). SFF is one of the largest fintech tradeshows in the world, with over 60,000 delegates from 150 countries. In partnership with Global Victoria, Investment NSW, FinTech Australia, and The RegTech Association Austrade co-facilitated business-matching – developing leads for new partnerships.

At the Australia Pavilion, EzyRemit signed an MoU with Indonesian remittance service Faspay. Austrade introduced the companies at the 2022 Singapore Fintech Festival (SFF 2022). The companies announced the significant partnership at the same event, one year later.

‘Being part of Team Australia is attractive to our clients,’ says Nguyen. ‘With an increasing number of scams, it is hard to know who to trust. Austrade gave us profile support and opened doors to potential new partners.’

‘This partnership opens trade procedures and money transfer solutions between Australia and Indonesia,’ adds Faspay’s CEO, Eddy Tju.

Austrade also introduced EzyRemit to the Trade Commissioner at the High Commission of Canada to Singapore at the SFF 2022. As a result, Canadian officials fast-tracked EzyRemit’s market entry into Canada, leading to its North American expansion.

Future plans

EzyRemit is exploring capital raising for scaleup in 2024. The company aims to grow market share in existing markets and continue to find new markets.

‘We look forward to opening an EzyRemit Frankfurt office, later this year,’ says Nguyen. ‘With the support of Austrade, we continue to expand our global reach.’

Sign up to receive the latest news and insights about Southeast Asia.

Go further, faster with Austrade

Austrade’s Go Global Toolkit helps you learn the export basics, find the right markets and understand market requirements.